For entrepreneurs interested in launching and scaling their Amazon businesses, the upfront investment can be the biggest barrier to entrepreneurial success. As an Amazon seller, you may require additional working capital to grow your business and increase your product offerings, and the odds are stacked against you when getting assistance from a traditional lender. Fortunately, Amazon seller loans exist as an option for fast funding to boost your business.

Is taking out one of these Amazon seller loans the best option for e-commerce business funding? It depends! Similar to taking out a loan for a car or mortgage, not all loans are created equally. In this article, we’ll explore a few popular online seller loans available for Amazon sellers, what they entail, and what to look for when considering short-term financing for sellers.

Does Amazon offer loans to sellers?

Yes! Amazon offers loans to its sellers, but there are other options for those looking for Amazon seller funding Before signing up for an FBA loan from Amazon, you may want to consider other Amazon business loans that may be more applicable or convenient for your situation.

7 Finance Options Available to Amazon sellers

With a diverse array of financing avenues available, Amazon sellers have ample opportunities to secure the capital they need to thrive in the competitive e-commerce landscape, with Amazon business financing options directly from Amazon or from others who understand the opportunities that extra cash for Amazon sellers can provide to get a nice return on investment.

Below, we’ll examine a few fintech solutions for Amazon sellers and how they compare to the alternative Amazon financing options.

Amazon Lending Program

Amazon Lending is an exclusive financing program offered directly by Amazon to help U.S. small and medium-sized businesses on the platform. Through Amazon business lending, sellers can access loans ranging from a few thousand dollars to several million, with repayment terms structured based on their sales performance on Amazon.

While the Amazon Lending Program is invitation-only, interested sellers can apply in minutes. Eligibility for Amazon Lending varies, but you’re able to find out your status in Seller Central and whether or not it’s available for you. Below we’ll discuss the pros and cons of the Amazon Lending Program so you can decide if it’s right for you.

- Pros:

- No credit score requirements.

- Rates tend to be inexpensive.

- Quick pre-qualification process.

- Fast and easy application.

- Cons:

- Available only to Amazon sellers.

- Limited information on the website.

- Disbursement may take up to five business days

Amazon Line of Credit

In partnership with Goldman Sachs, Amazon offers eligible sellers a revolving line of credit, providing greater flexibility in managing their cash flow. Sellers who successfully apply for an Amazon business line of credit can access funds up to their approved credit limit, and repayments are automatically deducted from their Amazon seller account. Below we’ll discuss the pros and cons of the Amazon Line of Credit so you can decide if it’s right for you.

- Pros:

- Flexible credit for Amazon purchases.

- Long repayment terms (up to 55 days).

- Dedicated account management.

- No collateral required.

- Cons:

- Limited to Amazon purchases.

- Potential origination fees.

- Rates may be higher than other options

Merchant Cash Advance Program

The Merchant Cash Advance Program allows sellers to receive a lump sum of cash in exchange for a percentage of their future Amazon sales. This option is ideal for sellers needing immediate funds with flexible repayment terms tied to their sales volume. Below we’ll discuss the pros and cons of the Merchant Cash Advance Program so you can decide if it’s right for you.

- Pros:

- Quick access to cash.

- No rigorous approval process.

- Useful for urgent expenses.

- Cons:

- High-interest rates.

- Repayment costs.

- Potential impact on credit score

SBA Microloans

The Small Business Administration (SBA) Microloan program offers an alternative avenue for sellers seeking smaller loan amounts. These loans, provided through SBA-approved intermediaries, cater to businesses with modest financing needs. While not specific to Amazon sellers, they can be utilized to fund various aspects of an e-commerce business, such as inventory purchases or marketing efforts. Below we’ll discuss the pros and cons of the SBA Microloans Program so you can decide if it’s right for you.

- Pros:

- Accessible to minority and bad credit businesses.

- Includes support through education and mentoring.

- No SBA loan fee.

- Cons:

- Low loan amounts (up to $50,000).

- Limited approved lenders.

Fintech Solutions

As online businesses have grown in popularity and scale over the years, traditional loan options can feel outdated and leave business owners wanting more to fit their unique needs. Because of this, others have swooped in to fill these needs within their business model. Fintech, short for financial technology, refers to innovative technologies and digital solutions that aim to improve and automate the delivery of financial services.

Fintech has transformed traditional financial services by making them more accessible, efficient, and cost-effective, ultimately reshaping how individuals and businesses manage their finances. Below, we’ll list and detail a few fintech solutions that offer loans for Amazon sellers. We’ll list a few popular options further below, but generally, the pros and cons for fintech solutions are as follows:

- Pros:

- Tailored to e-commerce needs.

- Quick access to capital.

- Simplified processes.

- Cons:

- Specific eligibility criteria.

- Varying terms and fees.

Payability

Payability Capital Advance is a financial service designed specifically for e-commerce sellers, including those on platforms like Amazon, Shopify, and Walmart Marketplace. It provides sellers with access to their future earnings upfront, allowing them to reinvest in inventory, marketing, and other growth initiatives.

Uncapped

Uncapped is a leading provider of working capital offering simple, transparent and accessible funding to high-growth brands, retailers and sellers across US, UK and Europe. They offer fixed term loans (plus a specialized product just for Amazon sellers) and lines of credit tailoring each offer to suit the business’ working capital needs. Thousands of brands already partner with Uncapped to increase their marketing budgets, boost inventory and fund purchase orders.

Personal Loans

For some sellers, personal loans may be a viable option to finance their Amazon ventures. While not specific to e-commerce, personal loans offer flexibility in terms of usage and repayment, albeit with potential risks to individual assets.

If you’re considering starting an Amazon business but have yet to make the leap that would qualify you for many of the aforementioned Amazon business financing options, a personal loan might make sense as an avenue to initial Amazon inventory financing.

- Pros:

- Few restrictions on loan purpose.

- Predictable payments.

- Fast funding.

- No collateral required.

- Cons:

- Potentially high-interest rates.

- Increase in debt load.

- No continual borrowing.

- Possible origination fees.

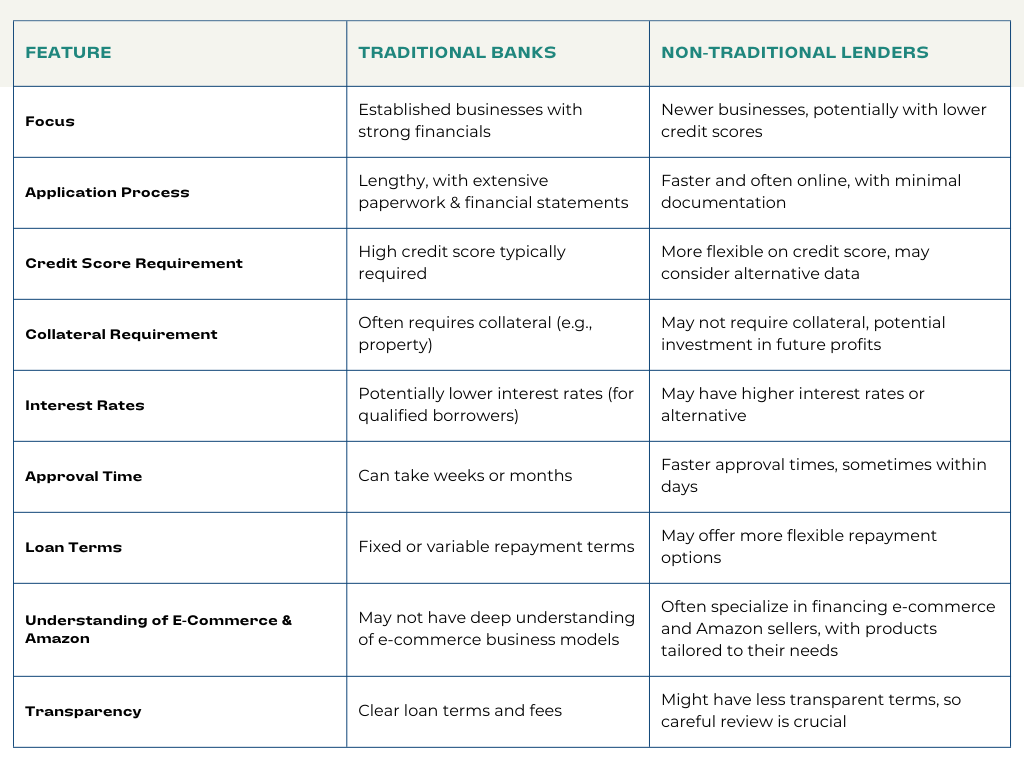

Pros and Cons of Non-Traditional Lenders

Decision Making Factors for Amazon Sellers

Deciding on the right Amazon seller loan hinges on understanding how the loan impacts your business in the long run. While a cash injection can do wonders for your business, it can be just as problematic without a solid, sound plan to make that money work for you. For the most part, the key factors to consider include interest rates, repayment terms, and the impact on your business.

Interest Rates

Borrowing money for your business comes at a cost. According to NerdWallet, the average business loan interest rate typically ranges from 5.89% to 12.23%. However, the rate can change depending on the lender, loan type, financial situation and history, and changes in the money markets. Generally speaking, the lower the interest rate or annual percentage rate (APR), the cheaper the loan will cost you in the long run. Depending on variables, these rates can vary heavily, so it’s wise to shop around for the lowest rate.

Repayment Terms

Opting for a more extended repayment period might offer lower monthly payments but could entail higher overall interest costs. Conversely, shorter repayment terms may lead to higher monthly payments but less interest paid over time. Additionally, assessing whether the loan offers fixed or variable interest rates is essential, as it impacts predictability in budgeting.

Additionally, some loans entail a stake in your Amazon business, siphoning profits from the cash investment. AccrueMe utilizes a profit-sharing approach, aligning the interests of the seller and loan provider, as both benefit when the business thrives. It’s crucial to read the fine print on the length of payments and percentage of profits as repayment terms to ensure you don’t expose yourself and your business to too much risk in the long run.

Business Impact

Finally, weigh the potential impact on your business. Will Amazon seller loans fuel growth and increased profits, or might it strain your finances if sales figures don’t meet expectations?

While Amazon growth capital allows for some flexibility and freedom, the cash injection needs to have a positive impact on your bottom line to outpace the interest rate or repayment terms. This is where Viral Launch’s industry-leading software and trove of Amazon data can be valuable for you. With accurate sales estimates in Market Intelligence and meticulous sales tracking performance across the vast Amazon marketplace, you can get a reliable glimpse into what’s possible for your business if you can continue to climb organic rank and run efficient advertising campaigns that increase visibility and exposure to your product, resulting in extra sales.

By carefully assessing these data points and forecasting your business’s potential risk and reward, you’ll be well-equipped to choose the financing option that best propels your Amazon business forward.

Make the Right Financing Choice for Your Amazon Business

As you can see, there are plenty of ways you can be creative when seeking funding for Amazon sellers. From Amazon’s own lending programs to third-party fintech lenders and traditional financing options, there are a variety of options for how to get Amazon loans to uplift your business.

Each option comes with its benefits and considerations, requiring sellers to evaluate their financial needs and objectives carefully. By understanding the ins and outs of these Amazon seller loans and their impact on your business through the Viral Launch software suite, sellers can make informed decisions to fuel growth and success for their Amazon business while mitigating risks.