If you’ve been in the Amazon seller space for any longer than a month or two, you should be no stranger to change. This past weekend was a reminder of how frequent and inescapable this change can be. The most recent change comes in the Amazon keyword search volume and relevance data area.

What change did Amazon make?

Mid-day on Thursday Dec. 13th, Amazon pushed a code change upgrading the technology behind some of their internal APIs. One of the APIs that was recently updated had been feeding a few software providers (including Viral Launch) with exact and broad match search volume, as well as product relevancy data. This change removed these metrics (Amazon keyword search volume and relevance) from the API, leaving software providers without the ability to grab fresh Amazon keyword search volume data directly from Amazon.

Did Amazon remove these metrics in spite of software providers? While there is no way of knowing for sure, my assumption is that through the process of upgrading this API, Amazon found no need to continue sending these specific metrics, as they were not being shown in any of Amazon’s user interfaces. It seems unlikely Amazon would change the technology behind their APIs simply to remove the data. My guess is that they decided to stop showing any “unnecessary” information through the upgrade process.

What Does This Mean For You, as an Amazon Seller?

While it’s no question that the lack of access to updated search volume is disappointing, the playing field has been leveled as your competitors have also lost access to fresh search volume.

The opportunity now exists to find the new advantage and best solution to identifying and prioritizing your keywords. With change comes opportunity.

The best solution to identifying and prioritizing keywords comes in two forms:

- Using software capable of leveraging historical data and sophisticated means of forecasting and estimating

- Using PPC and organic performance data to understand how buyers respond to your product.

I think it’s important to note that we will never try to downplay the importance of Amazon keyword search volume on our listing optimization, PPC, and SEO/ranking strategies. With that said, search volume alone has never been the complete answer.

Understanding metrics per keyword – like PPC conversion rate, average selling price and review quantities for top ranking products, etc. – have all played a significant part in our keyword strategies in the past and will continue to in the future. Being able to understand and interpret this data actually becomes that much more important.

How This Impacts Our Tools & How We Can Help You Gain an Advantage

The Viral Launch data science and engineering teams have been working incredibly hard to bring a sophisticated, data-driven solution that is capable of accurate forecasts and providing the transparency you need to logically get behind our new models.

A major focus of this new solution is transparency. In order for you to trust our new estimates and feel comfortable making informed business decisions, we want to help you understand how we are arriving at our numbers. And it’s this level of transparency that we are integrating into our new solution.

With sales estimates, sellers can validate or invalidate the accuracy of the data by comparing the estimates to their own product’s real sales. But with search volume, there is no absolute way to validate or invalidate the data. When a tool provides a search volume estimate, it is more or less saying, “Hey, trust us… this is good!” I want to shift that ask of trust to, “Hey, here is the process we’re using, and this is why we believe this is the right number.” In essence, don’t trust what we are telling you, trust what we are showing you. Allow us to walk you through it.

The Future of Amazon Keyword Search Volume Estimates

We are beyond excited to share that our current models are forecasting at 75-85% accuracy depending on the keyword. (I’ll talk through our validation strategy in the section below)

At the conclusion of this blog we added a Deep Dive section where we go into the specifics of our new search estimation process. We want to help you understand what we’re doing at a high level to be able to achieve such great results.

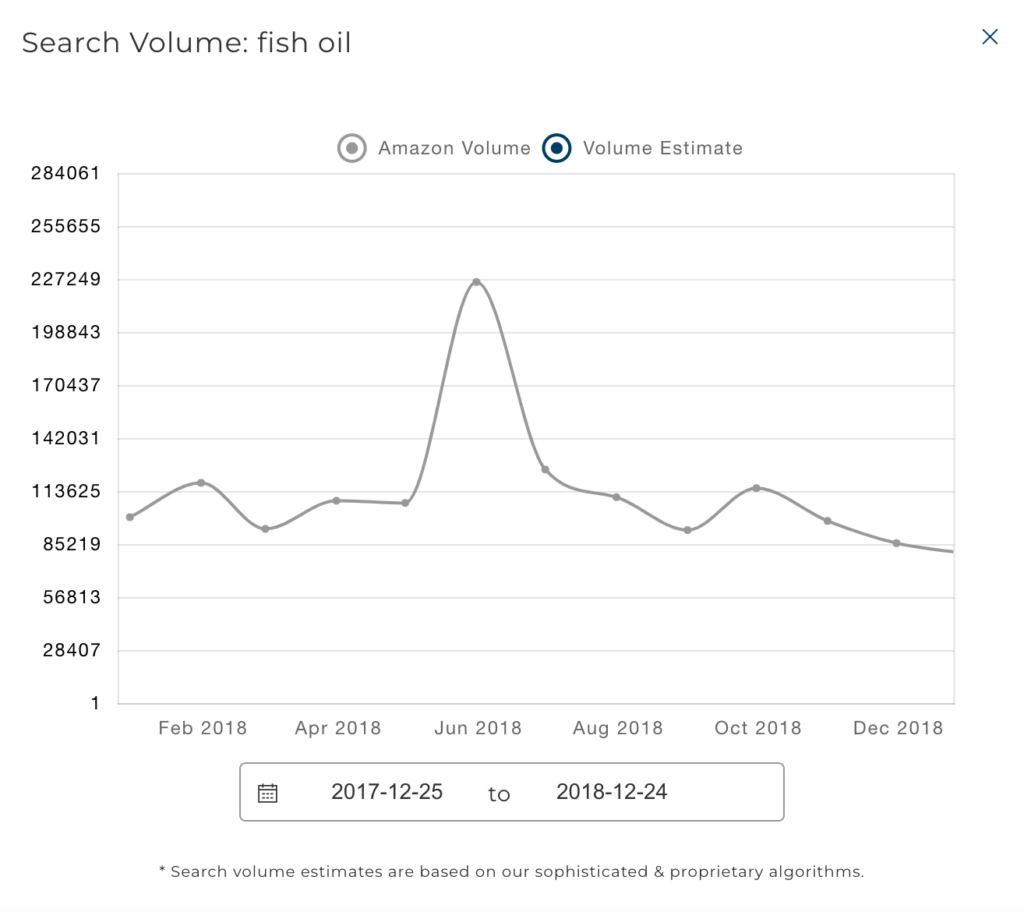

One of the major saving graces here is that we have a full year of historical search volume data for many keywords! (We started tracking volume on Dec. 12th 2017 and things closed down on Dec. 13th 2018).

This historical search volume is incredibly important for a couple of reasons:

- We will consistently show sellers the historical search volume trend so you can see what the exact volume was at the same time last year. This way you will always be able to use “exact” numbers in your decisions versus our in-house estimates.

- It will be the baseline for our search volume estimates moving forward, as typically the best indicator of what will happen in the future is what has happened in the past.

While historical volume is a good indicator of the past, it would be foolish to think that search volume is going to remain the same in 2019. For this reason, we will use other data sources to help us estimate the amount of change in consumer shopping behavior.

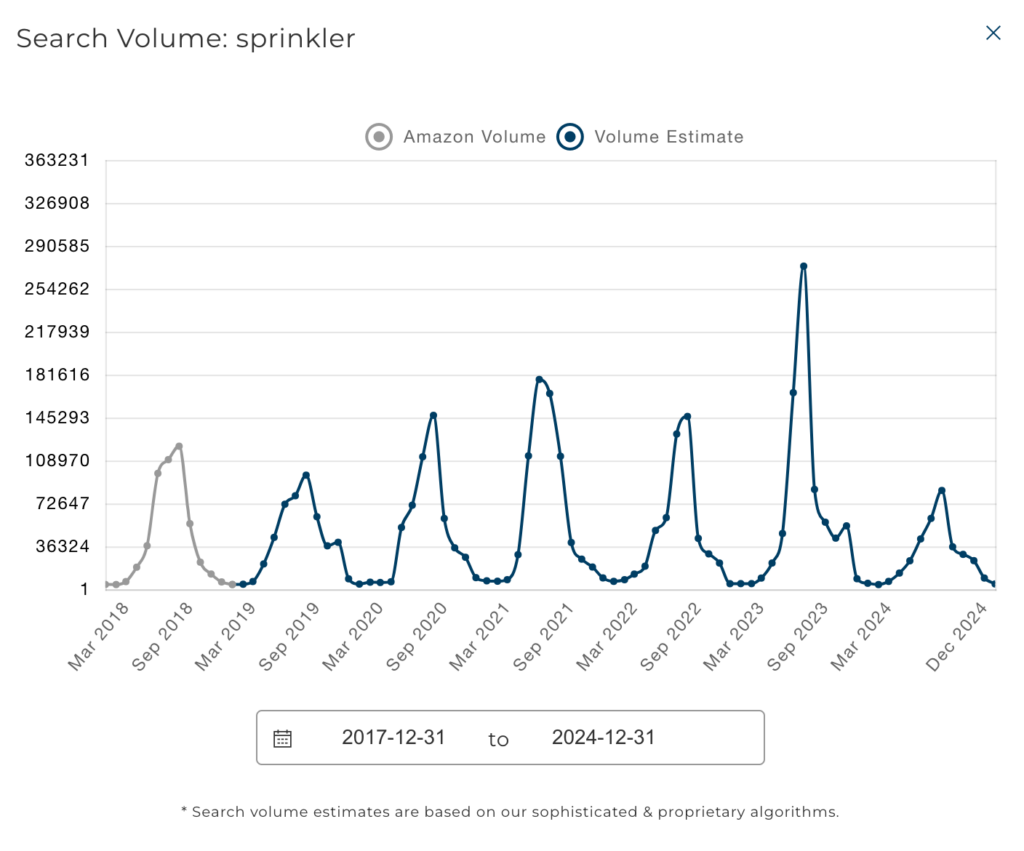

One data source that improves our forecasting models is change in estimated sales volume for a keyword’s top ranking products. We are not looking at the number of estimated sales. We are looking at the trend in estimated sales month to month.

For some keywords, Amazon search volume and sales volume are highly correlated, making changes in sales a great indicator of changes in search volume. Here is a simple illustration (not the actual model):

We’ve overlayed the graphs of Amazon search volume for “sprinkler” and estimated sales volume for the same keyword. They trend very similarly throughout the year for the same keyword. In this case, it means we would use Amazon sales behavior as a means of forecasting, while also using our historical data for this keyword.

In other instances, the trends of Amazon search volume and sales for the top ranking products are not statistically correlated.

We take this same approach for other data sources such as Google search volume trends, etc. Using our massive swath of historical and real-time data, our data science team is capable of using machine learning to programmatically discern which data sources are good and which are bad for each keyword at scale.

The beauty of this approach is it allows us to figure out which data sources are reliable predictors on a per-keyword level, so we never use a data source that would be misleading.

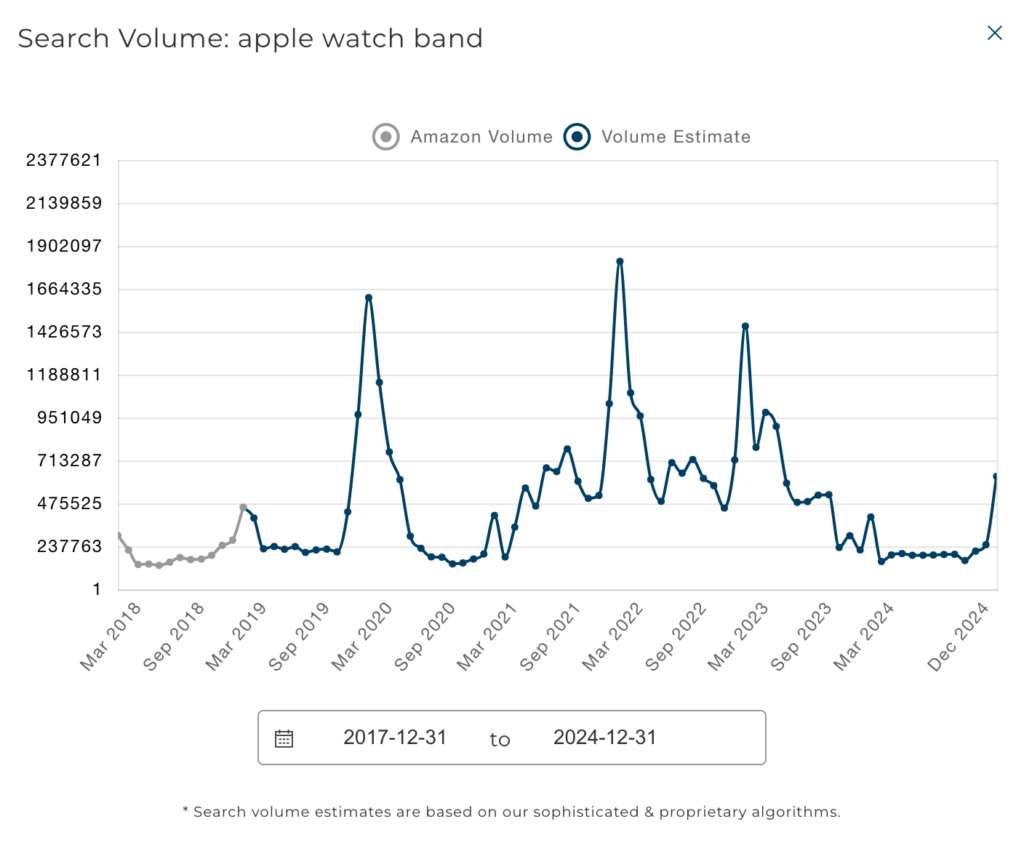

Here is what the new user interface looks like:

As you can see in the image above, transparency is the focus. We show the changes in external factors so you can begin to understand how we arrived at our new estimates. You are also capable of comparing our new estimate with the historical exact volume.

Versus keeping our new search volume algorithm secret, our hope is that this allows you to make the most informed decisions possible by seeing historical data along with how we’ve arrived at our new estimates!

As we continue to identify additional data sources, new statistical/forecasting models, or come up with new and clever ideas, we will continue to improve our search volume estimates with full transparency.

This is a large scale engineering and data science effort, so you will see this change rolling out in our Keyword Manager and Keyword Research tools beginning at the end of next week and propagating over the next few weeks to all words within our database.

The Future of Relevancy Score

We are extremely sad to see this metric go as it had wide-sweeping implications for some of our tools and our ability to help boost sales for our customers. Our short-term plan of action is to show historical relevance score for products we’ve already analyzed, while removing it for those we have not.

While we are sorry we will no longer be able to show you this metric for now, relevancy score is a just a proxy for an even more important metric you will see soon in another tool we have in the works.

Looking Forward

“When you’re finished changing, you’re finished.” – Benjamin Franklin

The longer you have been in the Amazon seller space, the more change you have experienced. When building a business on top of another platform, one of the keys to success is adaptability. The sellers that focus on the opportunity that comes from change, versus those that lament over what was, will have the most success now and in the future. Sadly, I know massive sellers that were devastated by Amazon’s TOS update around reviews in Oct. 2016, where they went from making millions on Amazon to almost nothing within a year because they were unable to adapt. Conversely, I know plenty of sellers that took advantage of the newly evened playing field and have built massive 7-8 figure Amazon businesses since that same review update.

There will be plenty more changes in the future. Your success will be dependent on how well you’re able to leverage your network, team, and resources to turn the new dynamics into a competitive advantage! And we hope we get to help you do that!

Validation Strategy

When building any type of model, whether it’s sales estimates, inventory forecasting, or search volume estimates, you should use 70-80% of the data to train the model. This is what the machine learning model uses to “learn” and then test the new model against the reserved 20-30% data set. This ensures that you are overfitting to data your model has already seen.

In our search volume validation testing, we took a subset of a keyword’s historical data (example: take 9 out of our 12 months of data), used that to train the model and understand correlations in our external factors, and then predicted out the next three months. In those predictions on the next three months, we were ranging between 75-85% accurate!

We’ve been incredibly impressed with the results, and we are confident these new estimates will be critical to your competitive advantage in selling on Amazon in 2019.

WE LOVE FEEDBACK!

We took a bit of risk by being the first to offer a solution; a solution focused on transparency. We’d love to know what you think! Our goal is to help you make the best data-driven decisions possible to have success in your Amazon business. Did we succeed here? Please let us know what you think in the comments!

You will be able to see our new search volume estimates starting next week for increasingly more keywords in our Keyword Research tool and powerful Keyword Manager/Tracker!

——- Deeper Dive ———

Why Not Use PPC Data, Auto-Complete, or Bing Data?

As we brainstormed potential data points that could or would lead to superior estimates moving forward, we considered a significant variety of metrics. We wanted to help you, the seller, understand why we did not use some potentially “obvious” metrics, and why we DID use others.

Why Not Use Amazon PPC Data

Amazon PPC data was one of our first candidates for data points to use in building out our new search volume estimation model. In talking with our R&D team, we realized how these metrics could be quickly misleading.

PPC Impression Data

The idea is simple. If a product’s ad is being shown at the time of search, then it should show (receive an impression) approximately the same number of times as it was searched right? So search volume and ad impressions should be pretty similar right? Hardly.

On mobile devices, a sponsored ad only receives an impression when the ad is loaded. On mobile, generally there is only one ad at the top of the search. After the first sponsored ad, ads are dynamically loaded once the shopper scrolls deep enough into the search results. Meaning, if we don’t have PPC access to the first ranking product for every keyword, then we will miss a significant percentage of impression volume.

On desktop, a sponsored ad receives an impression each time the ad’s page is loaded; however, consistency is the key. In order to get an accurate feel of impressions, we would need to have PPC access for a product running sponsored ads on the first page of each keyword, all day (doesn’t run out of budget), every single day (whole month). One search can also be counted as multiple impressions as users click in and out of listings, sponsored products shown as suggested in detail pages, and add to cart pages, etc.

Having the necessary access to data is a significant challenge. We believe we have the world’s largest set of data next to Amazon, but even we don’t have the necessary data to use search impressions at scale as an accurate indicator of search volume.

PPC Bid Data As An Indication of Volume

We originally tossed around the idea of using suggested PPC bid cost as a proxy for search volume (the more searches, the more people bidding, the more expensive it is). One of the major hurdles here is that suggested CPC can range quite a bit depending on how relevant Amazon deems your product for the keyword. Meaning that Product A with a high relevance may have a suggested bid cost of $.50 per click, while the less relevant Product B may have a suggested CPC of $1.25.

Why Not Use Amazon Auto-Complete

Amazon autocomplete is an ancient technique of using the Amazon search bar suggestions as an indicator of popularity.

The previous thought has always been that the suggested words populate in order of search volume. This would mean that suggested keyword #1 has higher search volume than suggested keyword #2, which has higher volume than suggested keyword #3, and so forth.

As we dove into the suggestions and worked to validate that Amazon was in-fact giving us suggestions in the order of highest searched keywords, we found that was not the case.

While Amazon’s fourth suggestion, which is “fish oil for dogs”, has a search volume of around 9,500 searches per month.

We found countless other examples where Amazon was not suggesting keywords in the exact order.

Disappointing.

Deep Dive Summary

All in all, I hope this helps you understand some of the logic behind why we did not go with some of the seemingly most “obvious” metrics for our Amazon keyword search volume estimation model. Again, transparency is crucial for us during this process!

We have undoubtedly been able to prove that our model is effective and accurate at predicting/forecasting/estimating search volume, leveraging our vast amounts of historical data.

If there is anything that you think we did not consider, or something we may have overlooked, we’d love to hear your thoughts and ideas! Again, our focus is on providing you the best data possible to make smart business decisions.

Now that we have a solution, let’s not focus on what has been, and let’s focus on the incredible opportunities that await us in 2019!

Excited to help you kill it this coming year. 🙂

Let us know what you think in the comments below and feel free to share this post with any of the larger Amazon community!